The world of banking is ever-evolving. From online services and UPI payments to the launch of payment banks, the face of traditional banking has changed forever. If you’re not familiar with what a payment bank is, you’re in for a ride.

Payment banks in India are popping up every day with an aim to bring more people into the formal banking system, especially those in rural and semi-urban areas. Airtel Payments Bank was the first payment bank to open in India, and since then, many have followed in its footsteps.

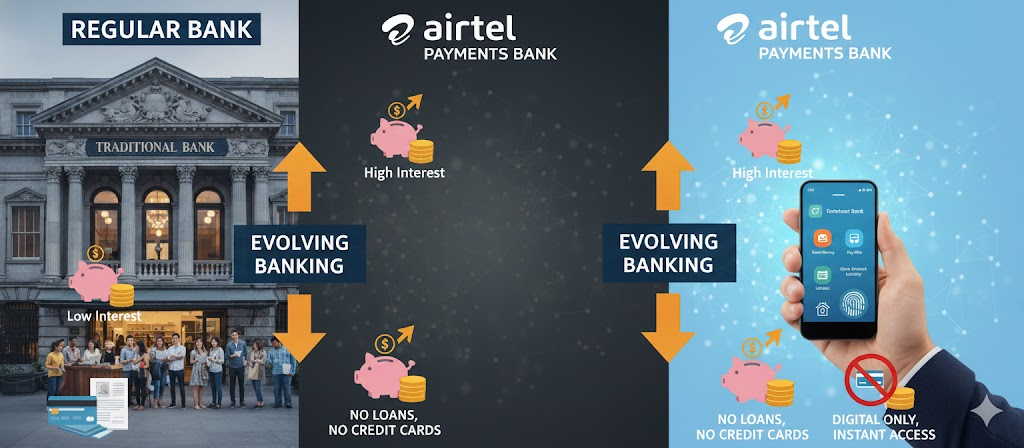

So, let’s break down what a payment bank really is and how it’s different from a regular bank.

So, What is a Payment Bank?

A payment bank is a type of bank introduced by the Reserve Bank of India (RBI) to increase the reach of banking services among the underbanked sections of the country. These banks operate on a relatively smaller scale and without any credit risk. However, they offer all the primary services such as savings accounts, payments, deposits, and digital transactions.

For instance, Airtel Payments Bank, one of the leading payment banks in India, allows customers to open savings and current accounts, book fixed deposits, do digital transactions, and even buy health insurance and digital gold. The whole idea of payment banks is to make banking accessible, simple and inclusive for every Indian.

Key Differences Between Payment Banks and Traditional Banks

Deposit Limits

While traditional banks let you deposit large sums of money with little to no restrictions, payment banks only accept deposits up to ₹2 lakh per customer. This limit is established as per the current guidelines of the RBI. So, you can easily use payment banks for everyday transactions, but not for large-scale investments.

No Loans and Credit Cards

One of the main differences between a payment bank and a traditional bank is that payment banks cannot lend money. On the other hand, regular banks thrive on lending through personal loans, credit cards, etc. The idea behind no credit is to minimise the risk of payment banks and keep the system secure for first-time digital users.

100% Digital Operations

The biggest advantage that payment banks have over traditional banks is accessibility. With Airtel Payments Bank, for instance, you can open a savings account in just minutes without needing to visit the branch or fill out lengthy paperwork. You can avail most of the services through your phone. That’s instant banking at your fingertips.

Focus on Payments

As the name suggests, payment banks prioritise quick, seamless transactions. You can pay utility bills, transfer money to your friends and family, do online shopping, and even recharge your phone. While regular banks also offer these services, payment banks are optimised for speed and convenience.

Attractive Interest Rates

Over the last few years, regular banks have become infamous for their low interest rates. Payment banks, on the other hand, offer higher interest rates. For instance, Airtel Payments Bank offers 7% p.a. on its savings accounts, one of the best among both traditional and payments banks in India.

Wrapping Up

Regular banks will continue to remain essential for complex financial services like loans and investments, but payment banks have a greater role to play in increasing the penetration of banking services to the remote and rural areas of the country. By making banking faster, easier, and more inclusive, payment banks are changing everyday banking.

And if you’re looking for a smart, secure way to handle your daily finances without stepping into a branch, Airtel Payments Bank is the perfect place to start.

Frequently Asked Questions

❓ 1. What is a payment bank and how does it work?

A payment bank is a type of bank licensed by the RBI that offers savings accounts, deposits, and digital payment services but does not provide loans or credit cards.

❓ 2. What is the difference between a payment bank and a regular bank?

The main difference is that payment banks cannot offer loans or credit cards and have a deposit limit of ₹2 lakh, while regular banks offer full banking services.

❓ 3. Are payment banks in India safe to use?

Yes, payment banks in India are regulated by the RBI and follow the same security guidelines as traditional banks, making them safe for everyday transactions.

❓ 4. What services does Airtel Payments Bank offer?

Airtel Payments Bank offers savings and current accounts, fixed deposits, UPI and digital payments, bill payments, insurance, and digital gold purchases.

❓ 5. Who should open an account in a payment bank?

Payment banks are ideal for people who want fast, digital-first banking for daily transactions, especially users in rural or semi-urban areas and first-time digital banking users.

❓ 6. How many payment banks are there in India?

As of now, there are 5 operational payment banks in India, including Airtel Payments Bank, India Post Payments Bank, Fino Payments Bank, Jio Payments Bank, and NSDL Payments Bank.

❓ 7. What is the difference between a payment bank and a regular bank?

The main difference is that payment banks cannot offer loans or credit cards and have a deposit limit of ₹2 lakh per customer, while regular banks provide full banking services.