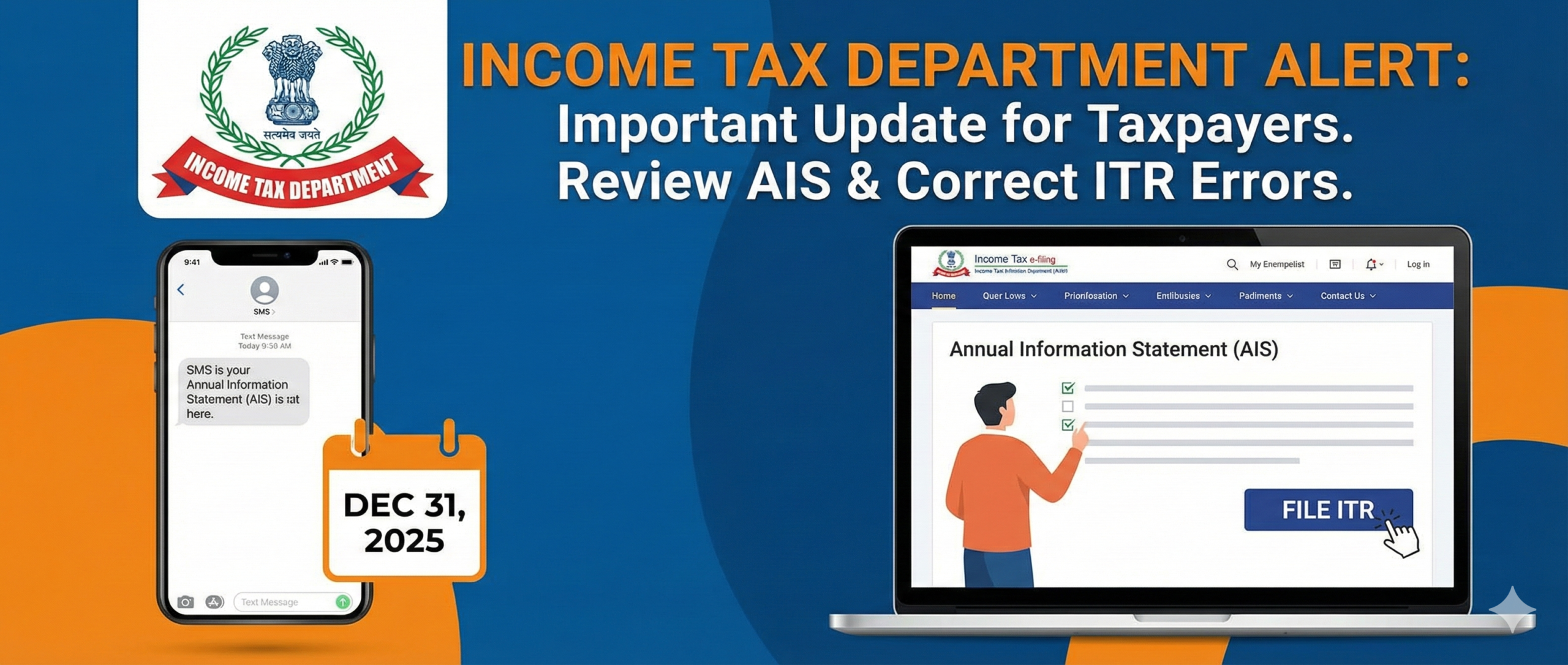

Have you received an SMS or email from the Income Tax Department? And now you’re confused about why? What’s next? The Income Tax Department has issued an important alert regarding this. Learn more here.

If you’ve received a notice from the Income Tax Department regarding a financial transaction, don’t panic. This isn’t a warning of any legal action. Rather, through this message, the Income Tax Department is advising you to file your ITR if you haven’t yet. If you have filed it and there are some errors, correct them. In light of the growing concern among users about the message, the Income Tax Department clarified the matter. The Income Tax Department stated that recent SMS and emails sent to taxpayers are not notices of penalties related to financial transactions.

In fact, some users are suspecting they may have made a tax error, which is why these messages are coming from the department. Many taxpayers have expressed concern about messages asking them to check their filings and withdraw incorrect claims. However, the department has stated that these communications are intended to help taxpayers review their income tax returns and correct any errors on their own.

What is the Income Tax Department’s message about?

- Taxpayers have been sent a message to review their Annual Information Statement (AIS) and correct any errors.

- The message also said that taxpayers can give online feedback through the compliance portal of the Income Tax Department.

- If required, they can revise the already filed return or submit the return if they had forgotten to file it earlier.

Opportunity to correct mistakes yourself:

Through these messages, the Income Tax Department is asking taxpayers to review their Annual Information Statement (AIS) and also giving them the message that if any mistake has been made, they are being given the opportunity to correct it.

Taxpayers can provide feedback online through the Income Tax Department’s compliance portal. If necessary, they can revise previously filed returns or submit returns if they forgot to file them previously. This step helps taxpayers avoid unnecessary scrutiny or future disputes. If you haven’t filed your ITR yet, you have until December 31, 2025.